Bitcoin 4-Year Cycle

Bitcoin follows a 4-year market cycle that impacts its price and the entire crypto market. This cycle is driven by a key event called the Bitcoin halving, which happens roughly every four years. At the same time, Bitcoin is also influenced by the global liquidity cycle (M2-money supply), which refers to how much money is flowing in financial markets worldwide. Understanding these cycles can help investors predict market trends and make smarter investment decisions.

Bitcoin’s 4-Year Market Cycle

The Bitcoin market cycle typically moves through four main phases:

1. Accumulation Phase (After the Bear Market)

- This phase happens after a market crash when prices are low, and most people have lost interest in Bitcoin.

- Smart investors (whales and long-term holders) start buying BTC quietly at cheap prices.

- Media attention is low, and the general public is skeptical.

Key takeaway: This is often the best time to buy, but most people ignore Bitcoin during this phase.

2. Bull Market (Big Price Surge)

- This phase starts when Bitcoin’s price breaks out of the accumulation zone and moves upward.

- The Bitcoin halving plays a big role here—it happens every four years and cuts the supply of new BTC in half, making Bitcoin more scarce.

- With lower supply and rising demand, Bitcoin’s price starts surging.

- Retail investors (the general public) start FOMO-ing in, driving prices even higher.

Key takeaway: This is when Bitcoin gets massive media attention, and new investors rush in.

3. Euphoria & Market Peak (Bubble Phase)

- Bitcoin reaches new all-time highs, and altcoins (other cryptocurrencies) also pump.

- People believe Bitcoin will never crash again, and mainstream adoption looks promising.

- Many investors hold on too long, hoping for even bigger profits.

- Eventually, the market overheats, and big players (whales) start taking profits.

Key takeaway: This is the most dangerous phase. Taking profits is essential before the cycle reverses.

4. Bear Market (Crash & Fear)

- Bitcoin’s price crashes hard, and most people panic sell.

- Negative news dominates the media—people say Bitcoin is “dead.”

- Many altcoins lose 90% or more of their value.

- Eventually, prices stabilize, and the cycle repeats itself.

Key takeaway: This is the hardest phase emotionally, but it presents a major buying opportunity for long-term investors.

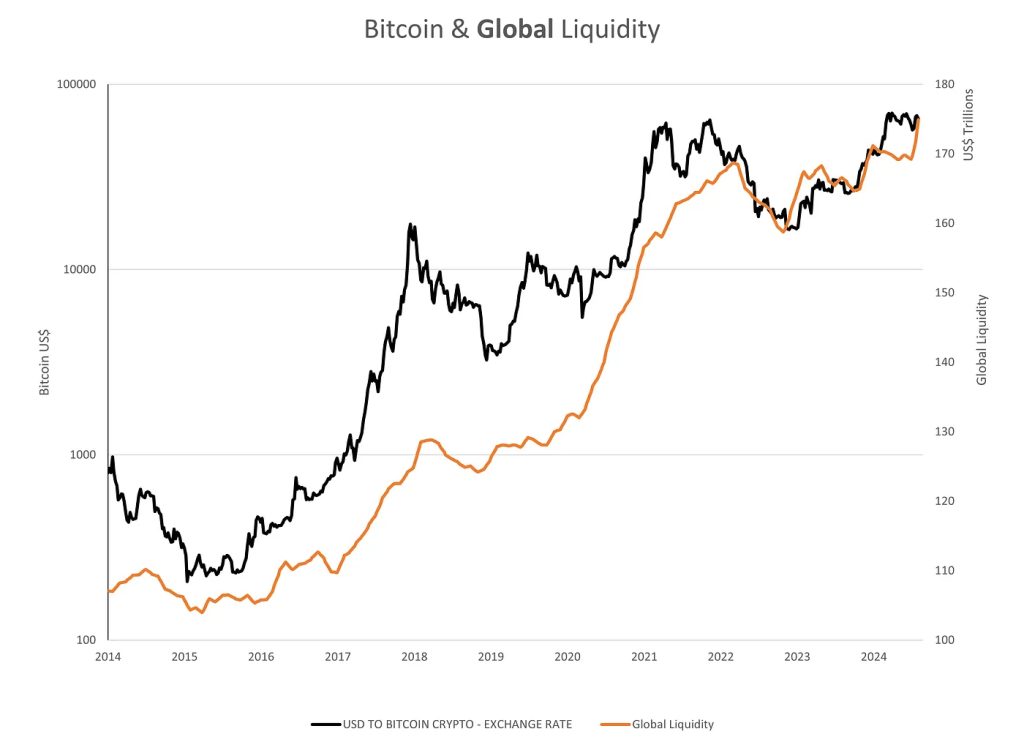

How the Global Liquidity Cycle Affects Bitcoin

Bitcoin doesn’t move in isolation—it’s also affected by the global liquidity cycle, which refers to the amount of money flowing in financial markets. Governments and central banks control liquidity by adjusting interest rates and printing money.

Liquidity Expansion (Easy Money)

- When central banks lower interest rates and print money (quantitative easing), more cash flows into risky assets like stocks and crypto.

- This often aligns with Bitcoin’s bull market, as investors have extra money to invest.

Liquidity Tightening (Hard Money)

- When central banks raise interest rates and stop printing money (quantitative tightening), less money is available.

- Bitcoin and crypto markets struggle because investors have less capital to spend.

- This often aligns with the bear market phase of Bitcoin’s cycle.

Global Economic Events & Bitcoin

- Events like the COVID-19 stimulus (massive money printing) boosted Bitcoin’s 2020-2021 bull run.

- The 2022 interest rate hikes drained liquidity, contributing to a crypto bear market.

Key takeaway: Watching global economic policies can help investors predict Bitcoin’s next move.

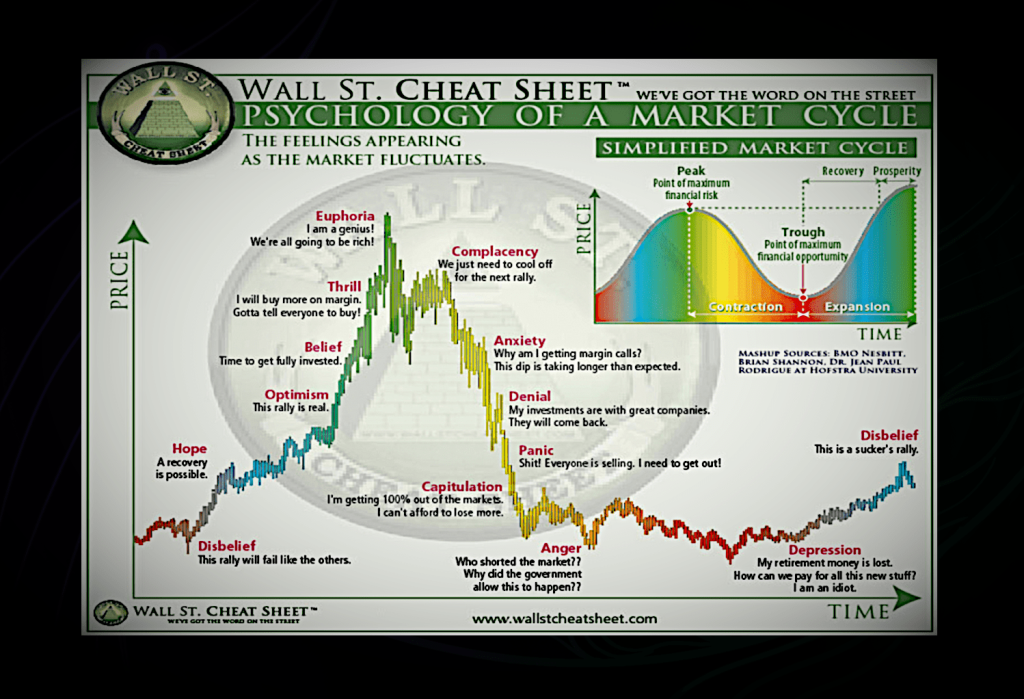

Wall Street Cheat Sheet

The Wall Street Cheat Sheet is a well-known chart that illustrates the different emotional phases that traders and investors go through during a market cycle. Understanding these phases can help crypto investors recognize emotional traps and make better decisions instead of reacting based on fear or greed.

Markets, including crypto, move in cycles, going from optimism and euphoria in a bull market to fear and despair in a bear market and thus well worth knowing that its normal when experiencing these emotions.