Which Crypto to Invest In?

With thousands of cryptocurrencies available, choosing the right one to invest in can feel overwhelming. Instead of relying on hype or social media trends, it’s important to do your own research (DYOR) and gather reliable information. Understanding a project’s purpose, technology, and market potential can help you make smarter investment decisions.

In this section, we’ll cover where to find reliable information on crypto projects, how to evaluate them, and useful tools that can help you identify promising investments.

Where to Find Information on Crypto Projects

Before deciding which crypto to invest in, beginners should gather reliable information from trusted sources. Here are the best places to start:

Coin Aggregator Websites

Websites like Cryptorank, CoinGecko and CoinMarketCap provide:

- Price and market cap data

- Trading volume and liquidity

- Historical price trends

- Developer activity and social engagement

- New Token Launch Information

A good place to find news and information on events that could potentially impact the crypto market is cryptopanic.

AI, Social Media & Community Channels

Platforms like ChatGPT, TokenInsight, and LunarCrush use AI to track market trends, analyze sentiment, and summarize complex information from multiple sources. AI can help identify potential risks, detect early trends, and provide insights on price movements, social media activity, and on-chain data. Other sources of crypto project information are:

- X (twitter): Crypto projects often post updates, partnerships, and roadmap developments. The GROK chat bot is extremely usefull on X to research a project, simply ask it for information, sentiment and/or social engagement of a project.

- Reddit: Subreddits like r/cryptocurrency and r/altcoin can provide insights from the community.

- Telegram & Discord: Many projects have active groups where you can ask questions and engage with the community.

- Youtube: YouTube can be a useful tool for discovering new crypto projects, but many influencers promote tokens for paid sponsorships. Focus on trusted analysts who provide research-based insights, and always do your own research (DYOR) before investing.

Evaluating a Project

Not all cryptocurrencies are good investments—some have strong fundamentals, while others rely on hype. To make informed decisions, it’s important to analyze key factors like driving market narratives, tokenomics, team credibility, and community engagement before investing. By using a structured evaluation process, you can identify projects with real potential and avoid scams or weak tokens.

In this section, we’ll break down the essential steps to research a crypto project, what to look for on platforms like CoinMarketCap and CoinGecko, and how to spot red flags.

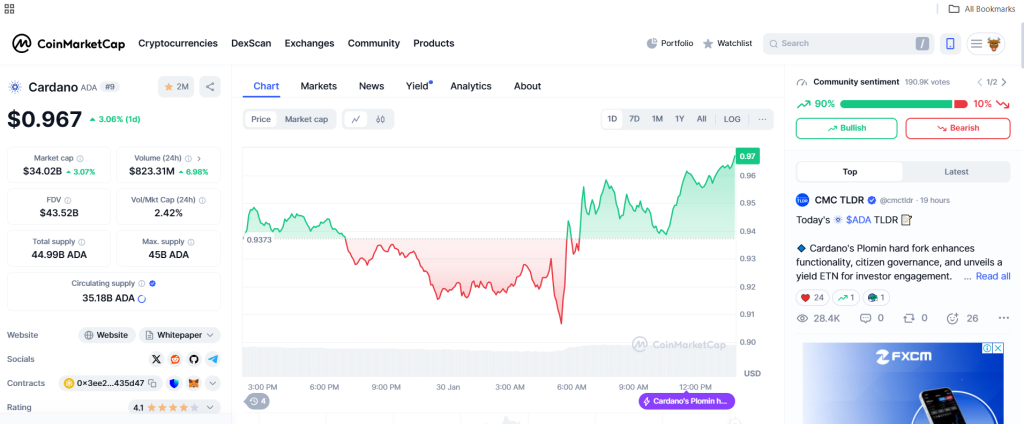

When evaluating a crypto project on CoinMarketCap, here are the key factors to consider:

1. Market Data & Liquidity

- Market Capitalisation: A higher market cap generally indicates stability, while low-cap projects can be riskier but have higher growth potential. Also look at the project’s Fully Diluted Market Capitalisation (FDV).

- 24-Hour Trading Volume: High volume suggests strong interest and liquidity, making it easier to buy and sell. Low volume may indicate weak demand or a dead project.

- Circulating Supply vs. Total Supply: Compare how many tokens are in circulation vs. the total supply. If a large percentage is still locked, future releases could lead to price drops.

2. Price & Historical Performance

- Look at the price chart to analyze past performance, trends, and volatility.

- Compare its all-time high (ATH) and all-time low (ATL)—is it recovering from a dip, or has it been consistently declining?

- Analyse the project’s price performance chart. Remember to zoom out as one can easily be caught up in the present performance. Past performance does not always mean future performance, but it does provide insight into a projects’ ability to navigate micro and macro environmental factors.

3. Project Information & Utility

- Website & Whitepaper: Click on the project’s website and whitepaper link to understand its purpose, technology, and roadmap. Note that technology in crypto projects are carrying less weight then the crypto narratives that is popular at the time. See the section below on narratives.

- Use Case & Utility: Does the token have a real-world use case, or is it just speculative? Strong projects offer clear utility within their ecosystem.

4. Exchange Listings & Token Holders

- Where is it listed? A token available on major exchanges (Binance, Coinbase, Kraken) is generally more credible than one only on small, unknown exchanges. Also consider that new crypto investors would most likely enter the market through a large exchange.

- Token Holder Distribution: Use blockchain explorers (Etherscan, BscScan) to check if a few wallets hold most of the supply—this could signal a risk of price manipulation. If the majority of the token supply are held by only a few, the token price will be significantly affected if these sell their holdings.

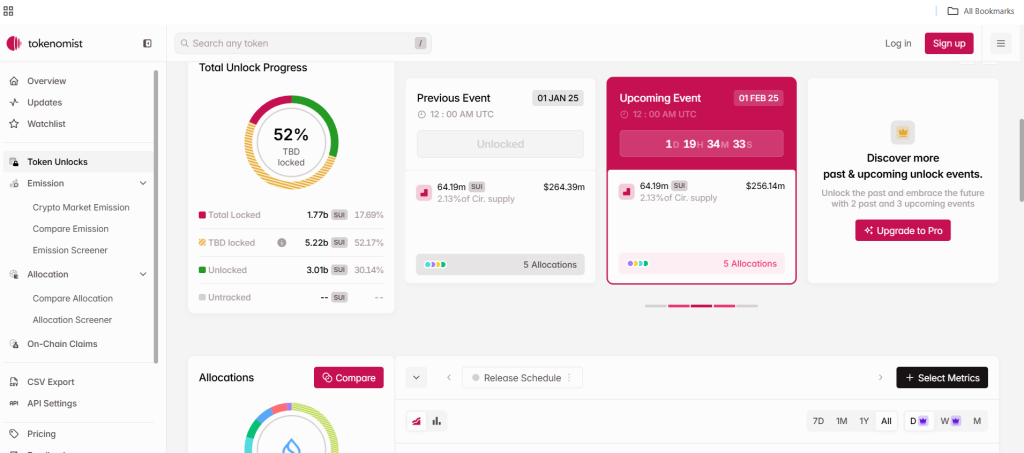

5. Token Locks & Unlock Schedules

- Vesting Schedules: Some projects lock a portion of tokens for early investors, team members, or development funds. If a large number of tokens are set to unlock soon, it could lead to a price drop as early investors sell off their holdings.

- Check Unlock Dates: Look for information on when locked tokens will be released. You can often find this in the project’s whitepaper, official announcements, or platforms like TokenUnlocks.app.

- Impact on Price: If a large token unlock is coming up, demand may struggle to keep up with the new supply, leading to price declines. Projects with gradual unlocks over time tend to have less selling pressure than those with large, sudden unlocks.

Always review a project’s tokenomics and unlock schedule to avoid buying before a major sell-off event.

Market Cap vs. Fully Diluted Market Cap

An important topic to understand is the difference between a crypto project’s Market Cap and its Fully Diluted Market Cap.

-

Market Cap (Market Capitalization): This shows how much a cryptocurrency is worth right now. It’s calculated by multiplying the current price of the coin by the number of coins available (circulating supply). A bigger market cap usually means a more stable and well-known project.

Formula:

Market Cap = Current Price × Circulating Supply -

Fully Diluted Market Cap (FDV): This is how much a cryptocurrency could be worth in the future if all possible coins were released. Some projects keep a portion of their tokens locked, so FDV gives a bigger picture of the total value once everything is available.

Formula:

Fully Diluted Market Cap = Current Price × Total Supply

Why It Matters: If a project has a much higher FDV than its current market cap, it means a lot of new tokens will enter the market in the future, which could lower the price. Always check when and how these tokens will be released before investing!

Why Narratives Matter in Crypto Investing

In the crypto market, narratives drive trends and influence investor interest more then anything else. A project’s success often depends not just on its technology but also on how well it fits into current market narratives—the big ideas and themes shaping the industry.

For example, in different market cycles, certain narratives gain traction, such as:

- Layer 1 blockchains (Ethereum, Solana, Cardano) during times of high developer activity.

- DeFi (Decentralized Finance) projects when interest in traditional banking alternatives rises.

- AI and Blockchain integrations when artificial intelligence is trending globally.

Understanding what narrative a project fits into helps investors gauge its potential for adoption, hype, and long-term growth. A strong project within a rising narrative may gain more attention, funding, and use cases—while a good project in a fading narrative might struggle to gain traction.