When to Take Profits?

Investing in cryptocurrency is exciting, but knowing when to sell can be just as important as knowing when to buy. Selling at the right time can help you lock in profits and avoid major losses. In this section, we’ll explore key strategies to identify the best time to sell your crypto investment, using Bitcoin as a guiding light for the market cycle. Remember that selling crypto is much harder then buying crypto, thus being prepared is crucial.

Bitcoin as the Market’s Guiding Light

Bitcoin is the largest and most influential cryptocurrency. It often leads the market, meaning that when Bitcoin rises or falls, altcoins (smaller cryptocurrencies) tend to follow. Understanding Bitcoin’s market cycle can help you predict what might happen to the rest of the crypto market. Typically, money flows in a pattern: first into Bitcoin as the safest and most recognized asset, then into mid-cap altcoins as investors seek higher returns, and finally into lower-cap altcoins, where speculation is at its peak. This cycle repeats in bull markets, with Bitcoin setting the trend and altcoins following suit.

Historically, Bitcoin goes through four-year cycles, largely influenced by the Bitcoin halving event, which happens approximately every four years. These cycles include:

- Accumulation Phase – Prices are low, and smart investors start buying.

- Bull Market – Prices rise rapidly, and excitement grows.

- Peak and Euphoria – Bitcoin reaches a cycle top, and altcoins follow.

- Bear Market – Prices drop significantly, leading to a long correction phase.

By studying Bitcoin’s movements, you can estimate when altcoins may also reach their peak.

How to Identify a Bitcoin Cycle Top

Finding the exact top of the market is difficult, but there are signs that can help you make an informed decision:

1. On-Chain Data Indicators

Analyzing on-chain metrics like:

-

MVRV Ratio (Market Value to Realized Value) – A high ratio suggests the market is overheated.

-

Exchange Inflows – When large amounts of Bitcoin are sent to exchanges, it may indicate that big investors (whales) are preparing to sell.

-

NUPL (Net Unrealized Profit/Loss) – Measures overall market profit and loss sentiment. A high NUPL score can indicate market overheating.

-

Puell Multiple – Compares miner revenue to historical norms. When miners earn significantly more than average, it can signal a market top.

-

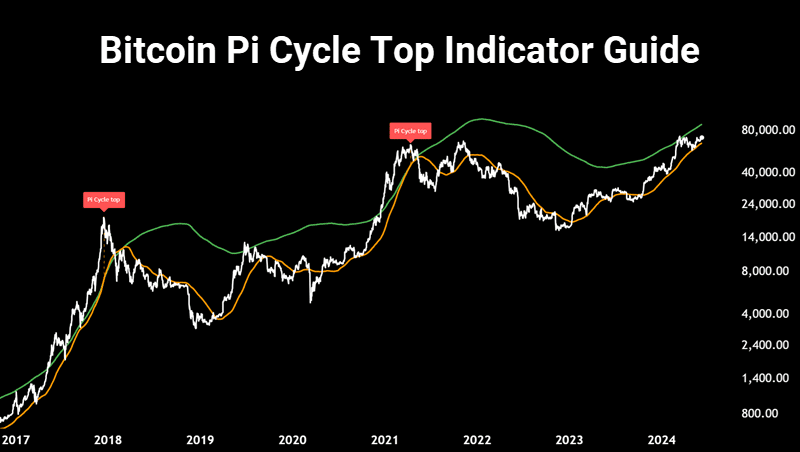

Pi-Cycle Top Indicator – A historically accurate signal that has identified Bitcoin tops in previous cycles using moving averages.

2. Extreme Greed in the Market

When the market is extremely greedy, it could be a sign that a top is near. You can check the Crypto Fear & Greed Index, which measures investor sentiment. If the index is in the “Extreme Greed” zone, it might be time to consider taking profits.

3. Parabolic Price Growth

Bitcoin (and altcoins) often rise too fast before a crash. If the price chart looks like a steep, unsustainable climb, history suggests a correction is near. This pattern aligns with the “Euphoria” stage in the Wall Street Cheat Sheet, where investors feel unstoppable just before a major downturn.

4. Bitcoin Dominance Drops

Bitcoin Dominance is the percentage of the total crypto market that Bitcoin represents. When this dominance falls sharply, it often signals that altcoins are pumping hard—usually right before a market peak.

5. Euphoric Media and Public Hype

When mainstream media starts talking about crypto non-stop and people with little experience start investing, it could be a warning sign that the market is nearing a peak.

Smart Strategies for Taking Profits

Having a clear exit strategy is important so you don’t make emotional decisions when prices rise or fall. Setting price and profit goals helps you lock in gains and avoid panic selling. Instead of trying to sell at the exact top, which is almost impossible and very few people hit that, consider these approaches:

Sell in Portions (DCA Out)

Just like Dollar-Cost Averaging (DCA) is used to buy crypto gradually, you can use it to sell. Selling in portions (e.g., 25% at a time) as the market climbs reduces the risk of selling too early or too late.

Set Price Targets

Based on previous cycles, you can set realistic price targets. For example, if Bitcoin reached 5x its previous all-time high in a past cycle, a similar increase might be a reasonable target in the future. Look at your porfolio and determine selling points/prices for each of the crypto tokens you hold. You may wish to sell certain percentages of your portfolio at certain price points. The key here is to be prepared and cut emotions out of selling.

Use Stop-Loss Orders

A stop-loss order allows you to set a price where your crypto will automatically sell if the price drops. This can protect profits in case of a sudden crash and remove emotions from selling.

Use the 2x Rule for Safety

- Some investors take out their initial investment once their crypto doubles (2x).

- This way, they keep holding while playing with “house money” (risk-free profits).

Final Thoughts

The best time to sell your crypto investment depends on market conditions, personal goals, and risk tolerance. While nobody can predict the exact top, using Bitcoin as a guiding light, watching market indicators, and employing smart selling strategies can help you make better decisions.

By staying informed and planning ahead, you can maximize your profits and protect your investments. If you’re unsure, consider taking profits gradually rather than waiting for the absolute peak.